income tax log in

The late filing fee is. Open PDF file 59994 KB for 2019 Form 2-ES.

Ais Error Correction How To Get Errors In Annual Information Statement Corrected For Itr Filing The Economic Times

An individual is considered a Senior Citizen if an individual crosses the age of 60 years during the financial year.

. For example John gets paid 50hour as an administrative director. Under the old income tax regime a higher tax exemption limit is available to senior citizens and super senior citizens. Personal income tax IRS applies to the income of citizens resident in Portuguese territory and non-residents who earn income in Portugal.

Estimated Tax Payment Options. Given below are the income tax rates for FY 2021-22 AY 2022-23 and FY 2022-23 under the old tax regime. Deduction cap for tax years 2018 to 2025.

0800 hrs - 2000 hrs Monday to Friday 0900hrs - 1800 hrs. This limitation expires on Dec. For a person or couple to claim one or.

Employers may need to handle a school district income tax. Education or health expenditure. Some tax laws impose taxes on a tax base equal to the pre-tax portion of a goods price.

States with local income tax. How to add bank account and prevalidate for refund Step 1. D Income of Decedents.

For more information about filing requirements and how to estimate your taxes see Individual Estimated Tax Payments. Remove a bank account from nomination so as not to receive tax refund in that. REGULATORY HISTORY 830 CMR 62101.

The amount of EITC benefit depends on a recipients income and number of children. Low income adults with no children are eligible. If you work and meet certain income guidelines you may be eligible.

Nominate a validated bank account to receive Income Tax refund. Savings are based on your income estimate for the year you want coverage not last yearYou may qualify to enroll in or change Marketplace coverage through a new Special Enrollment. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

If youre a part-year resident with an annual Massachusetts gross income of more than 8000 you must file a Massachusetts tax return. Online directly from your bank account free Log in to your online services account to schedule all 4 quarterly payments in advance. File income tax get the income tax and benefit package and check the status of your tax refund.

A Special Note on COVID-19 We understand COVID-19 impacts all aspects of our community. Income received by a decedent during his lifetime shall be reported by his executor administrator or person in charge of his property on Form 1. Unlike the income tax example above these taxes do not include actual taxes owed as part of the base.

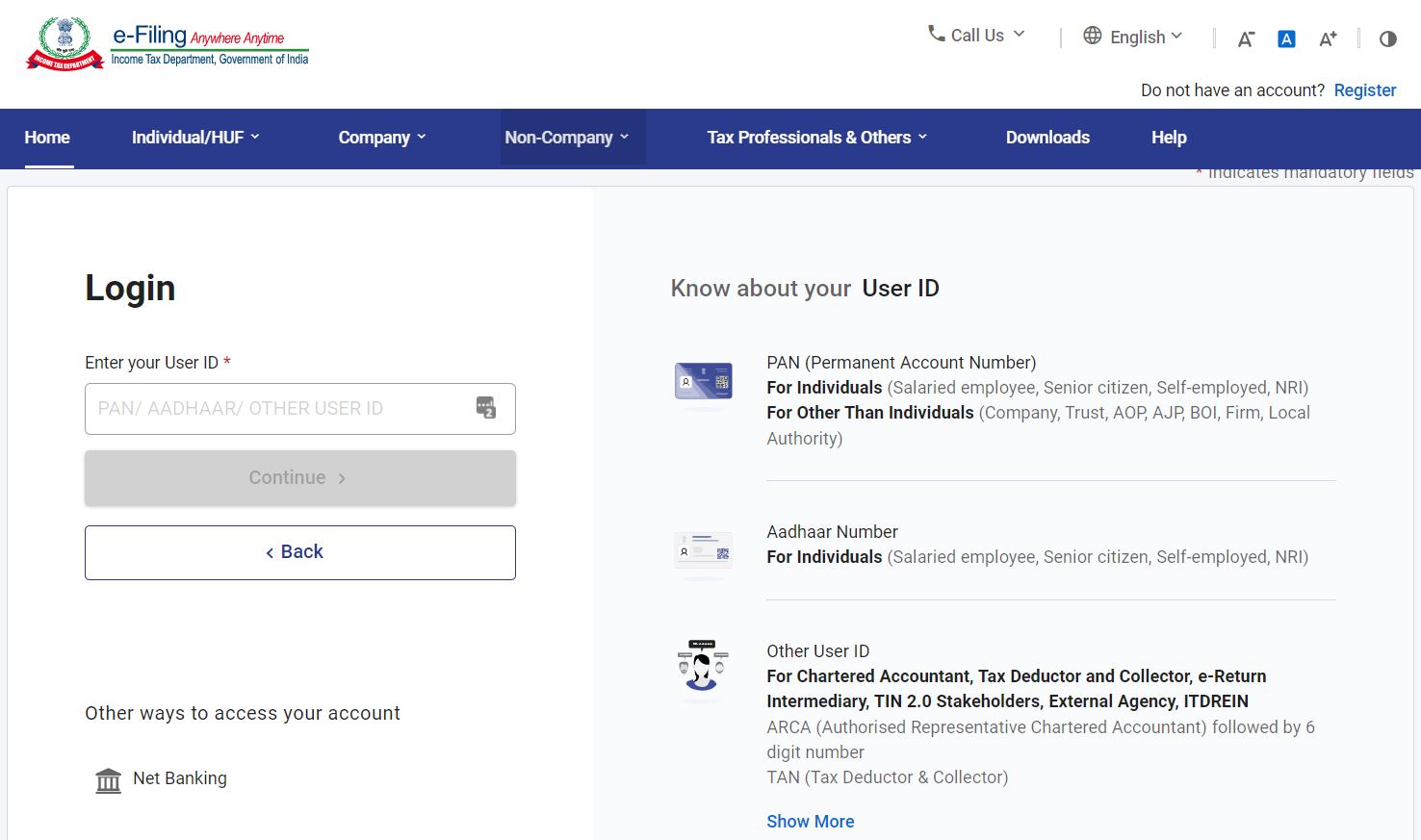

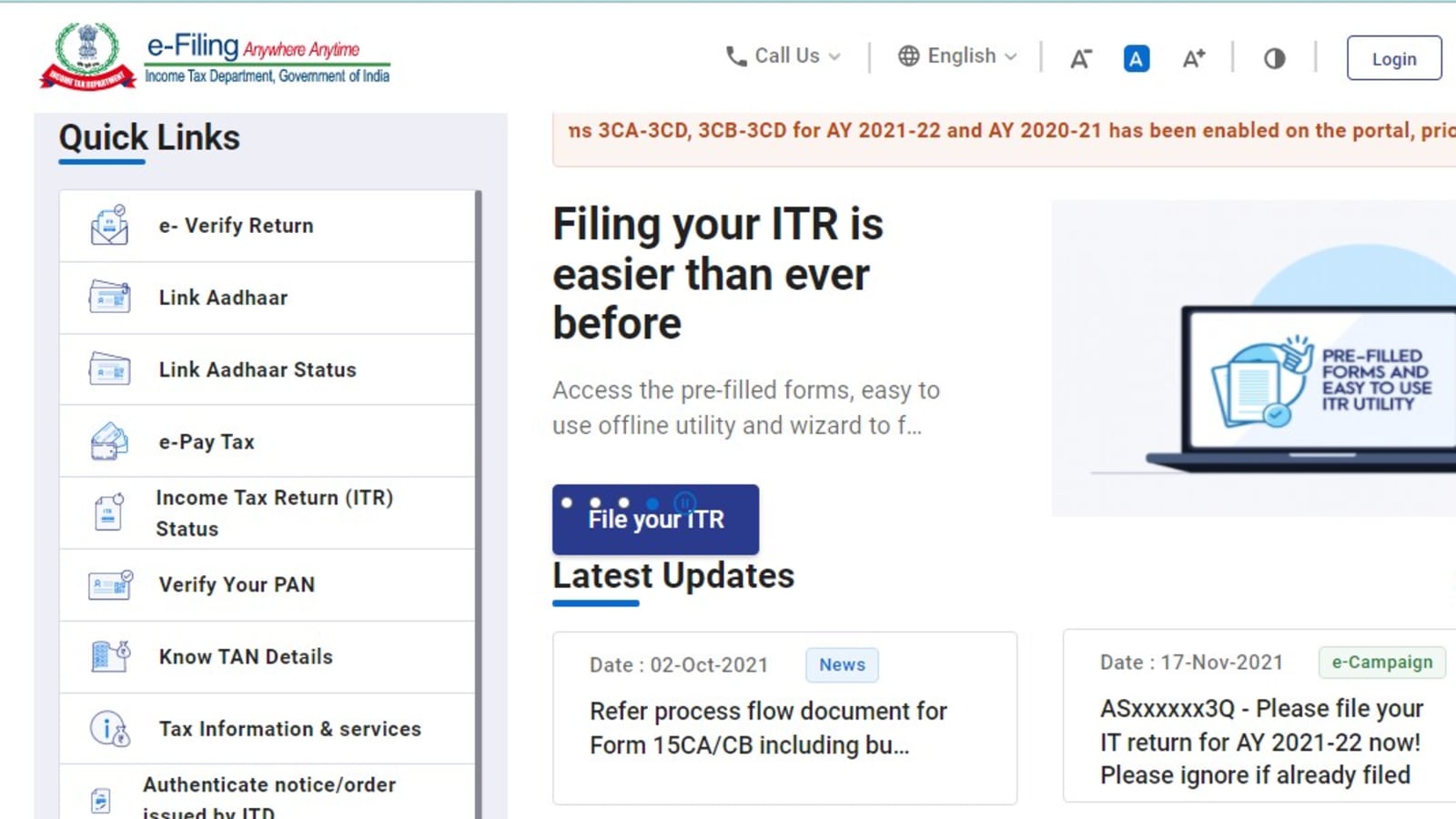

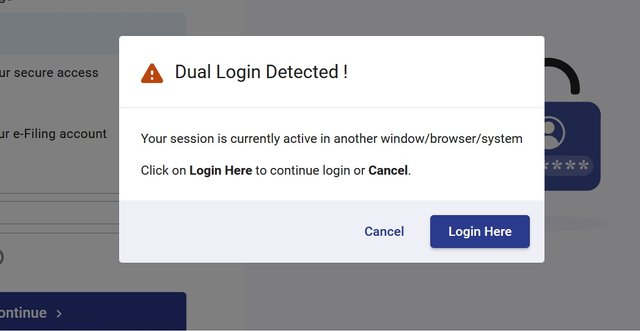

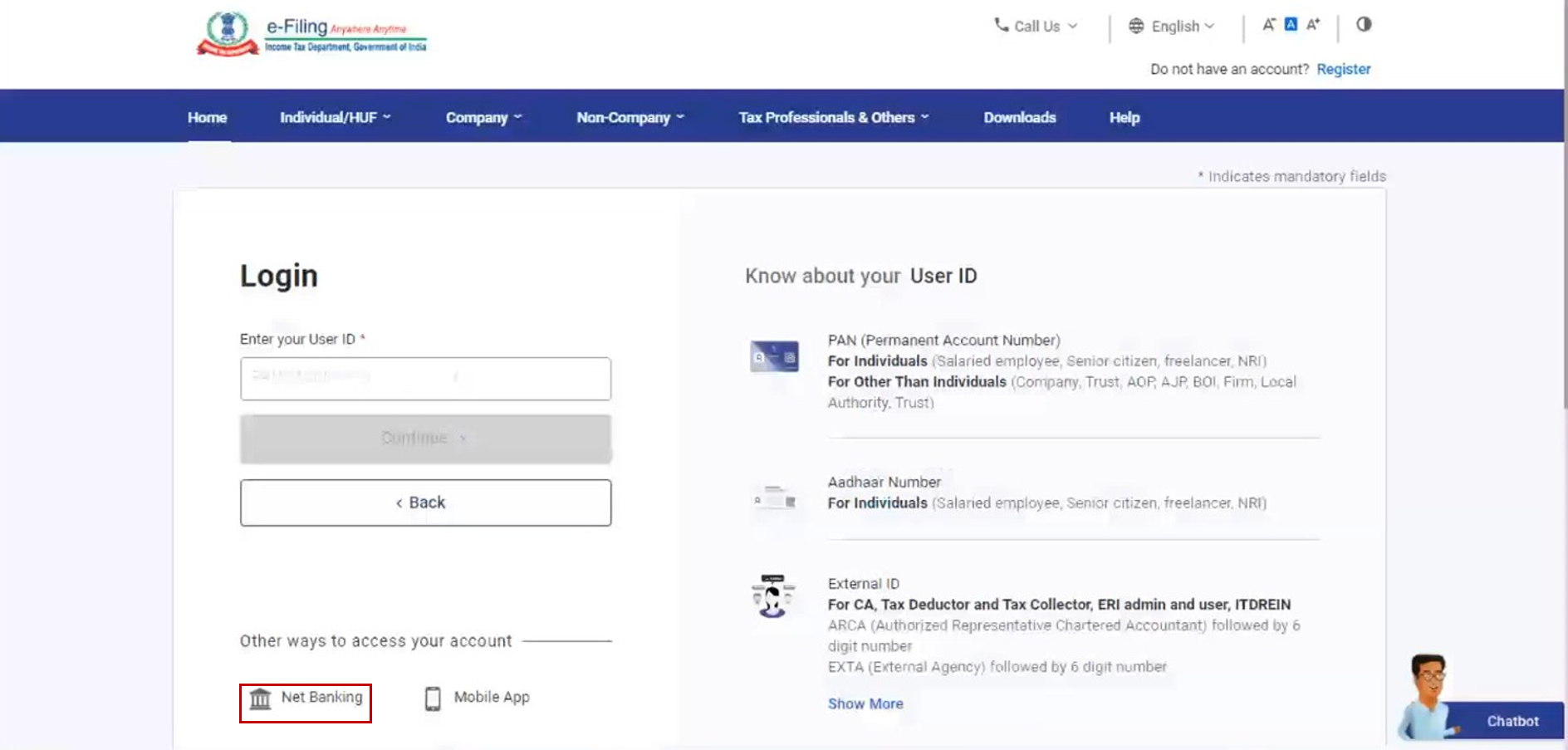

Log in to the e-Filing portal using your user ID and password. Use the following options to make estimated tax payments. Log in to the new e-filing portal at wwwincometaxgovin.

Presumptive Tax features under 44AD Scheme. Estimating your expected household income for 2022. Estimated Income Tax Payment Voucher Instructions and Worksheets for Filers of Forms 2 and 2G PDF 59994 KB Open PDF file 48265 KB for 2019 Form UBI-ES.

In some cases the tax is an income tax. Log into My Revenue. 1800 103 0025 or 1800 419 0025 91-80-46122000 91-80-61464700.

Check with your employees local tax office for more information. Efiling Income Tax ReturnsITR is made easy with Clear platform. E-file and Pay Your MA Personal Income Taxes File an extension for filing MA Personal Income or Fiduciary tax Check your refund with MassTaxConnect All other tasks View the Tax Year 2021 Filing Season Update Video Create your MassTaxConnect individual account Request a Certificate of Good Standing andor a Corporate Tax Lien Waiver View the.

Just upload your form 16 claim your deductions and get your acknowledgment number online. Gross monthly income is the wage an employee earns within a month before taxes or any other deductions. Income received thereafter shall be reported by his estate.

Go to the My Profile page from the Dashboard. A good priced at 80 with a 25 exclusive sales tax rate. Attached to Form IT-203.

Here we walk through the definition and how to find gross monthly income in different cases. Earned income credit. You cannot deduct anything above this amount.

As per the provisions under Section 44AD computed presumptive income 6 or 8 of gross receipts or turnover of the eligible business for the previous year is considered as the net income for the business covered under the presumptive taxation scheme. More help before you apply. In other cases it is a property tax.

You must pay Montana state income tax on any wages received for work performed while in Montana even if your job is normally based in another state. Move to Massachusetts during the tax year and become a resident. You are an individual part-year resident if you.

If a school district imposes a local tax all residents must pay the tax even if they work outside its boundaries. You can probably start with your households adjusted gross income and update it for expected changes. The limit is 10000 - 5000 if married filing separately.

2021 Westerville Business Income Tax forms are available below. E-Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries. However for small taxpayers the late filing fee is of Rs 1000 if the taxable income does not exceed Rs 5 lakh.

Go to My Profile from the dashboard. You can efile income tax return on your income from salary. Income Tax Planner gives you peace of mind as you strive to help clients grow and preserve wealth.

The tax is determined with reference to the income earned the corresponding rate being applied according to the relevant band and taking the deductions laid down by law into account eg. Income Tax on Trusts and Estates old number 900 Date of Promulgation. Although the tax itself is included in this figure it is typically the one used when discussing ones pay.

Gross salary is the amount your employer pays you plus your income tax liability. The income tax is taken off the top so the individual is left with 80 in after-tax money. His annual gross salary is 50hour x 2000 hoursyear 100000year.

Get the credit you deserve with the earned income tax credit EITC. With a wide range of powerful income tax planning and projection capabilities you can accurately provide your clients with the most comprehensive view of options to minimize their taxes with in-depth analysis and side-by-side comparisons. Your deduction for state and local income sales and property taxes is limited to a combined total deduction.

As per the current income tax laws a late filing fee of up to Rs 5000 is levied if a belated ITR is filed. Estimated Tax Payment Vouchers for filers of Forms 3M M-990T and M-990T-62 PDF 48265 KB. Move out of Massachusetts during the tax year and end your status as a resident.

IRS Tax Reform Tax Tip 2018-176 Nov. Used by nonresident and part-year resident Form IT-203 filers who need to report other New York State or New York City taxes and tax credits other than those reported directly on Form IT-203. Throughout this event we will work hard to keep you updated on the.

You can print the fill-in form attach your income documents W-2s 1099s Federal Schedules Sch CSch Eor Sch F and any other income documentation and mail them in to PO Box 130 Westerville OH 43086-0130.

Average Daily Log In Of 15 55 Lakh On Glitch Ridden Income Tax Portal

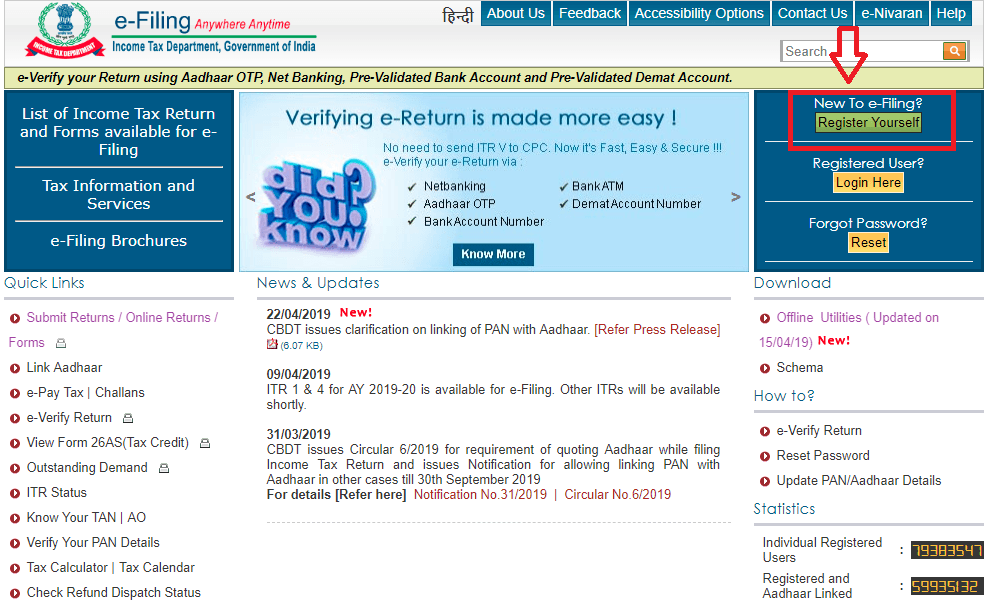

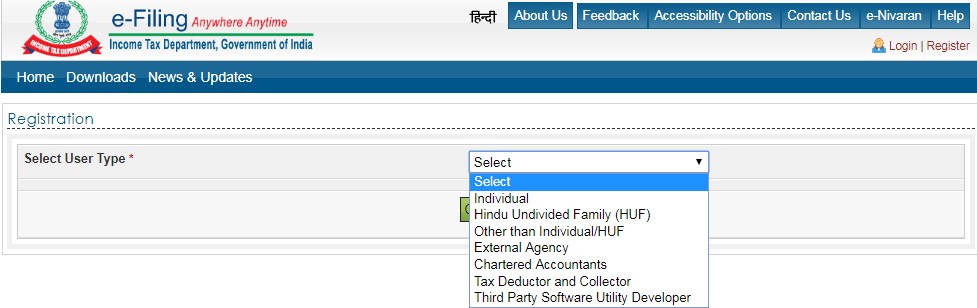

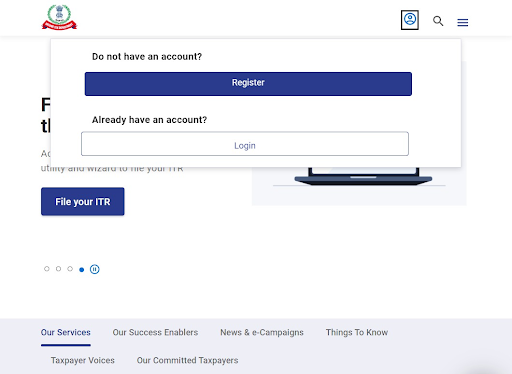

How Do I Register And Login On Income Tax Website

Income Tax Login Incometaxindiaefiling Gov In Itr E Filing Login

Heidi Ganahl Wants To Eliminate Colorado S Income Tax Which Accounts For About A Third Of The State The Durango Herald

Income Tax Portal Glitches Govt Says No Data Breach Seen Asks Infosys To Fix Know More

Income Tax Login And Registration Process In It Department Portal

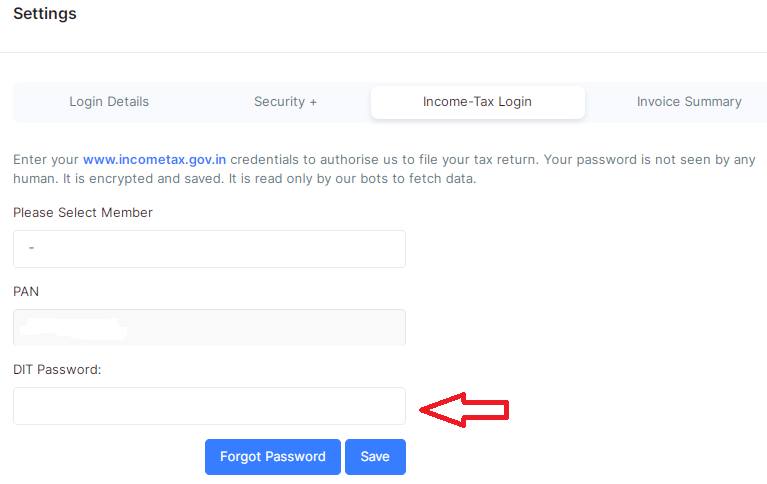

How To Enter Your Www Incometax Gov In Password In Myitreturn Login Myitreturn Help Center

Canada 2019 Corporate Income Tax Rates

How To Reset Income Tax Password Learn By Quicko

Incometaxindiaefiling Gov E File On Income Tax India Efiling Login

Income Tax India E Filing Portal Login Registration File Itr For 2020 21

How To File Income Tax Returns Online For Free Before Dec 31 Deadline On Incometax Gov In How To

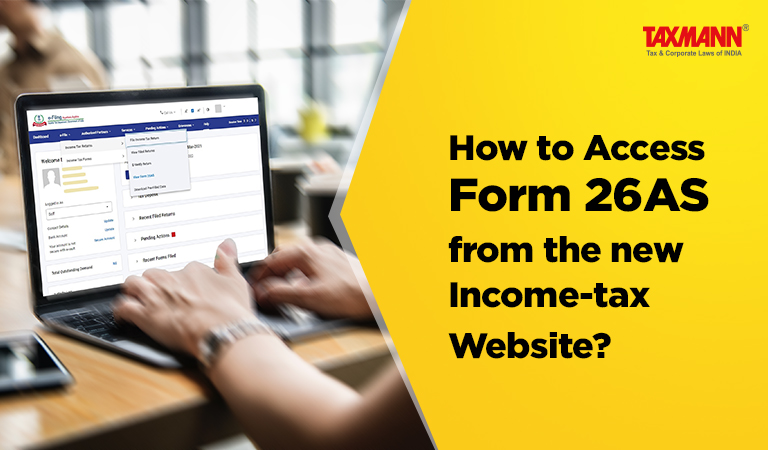

How To Access Form 26as From The New Income Tax Website Taxmann

Income Tax Efilling Step By Step

New York State Sales Tax Login Tax Ny Gov File Online New York State Tax State Tax

Freetaxusa Free Tax Filing Online Return Preparation E File Income Taxes

Income Tax Login Incometaxindiaefiling Gov In Itr E Filing Login

Comments

Post a Comment